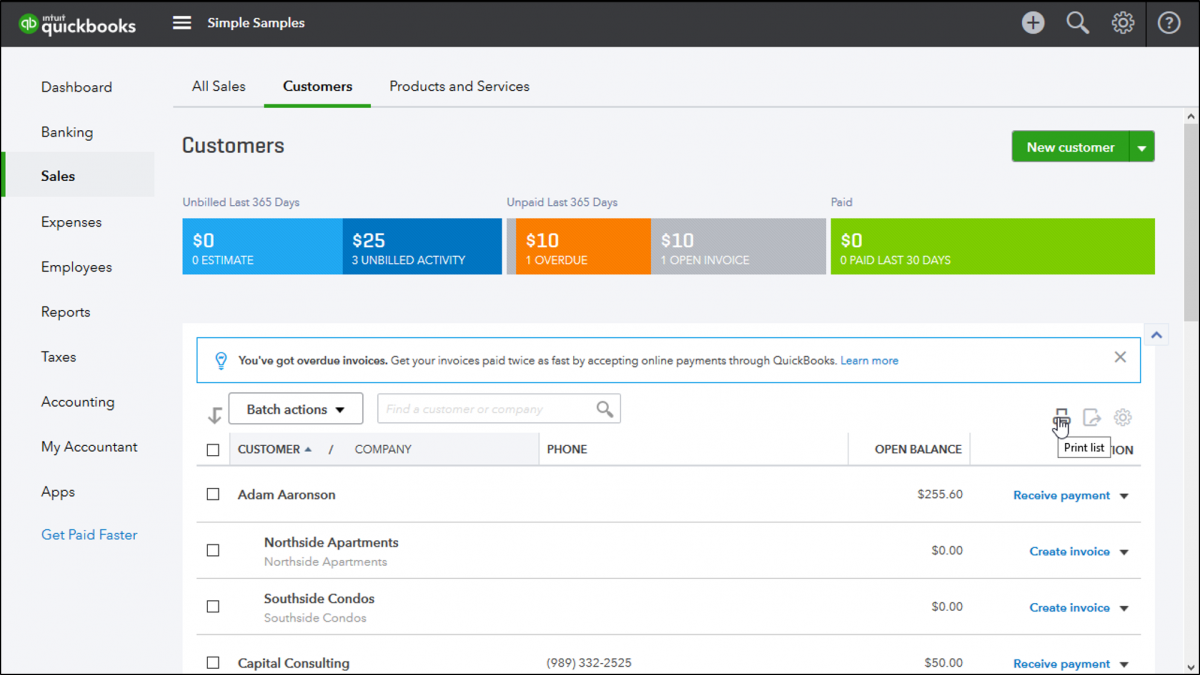

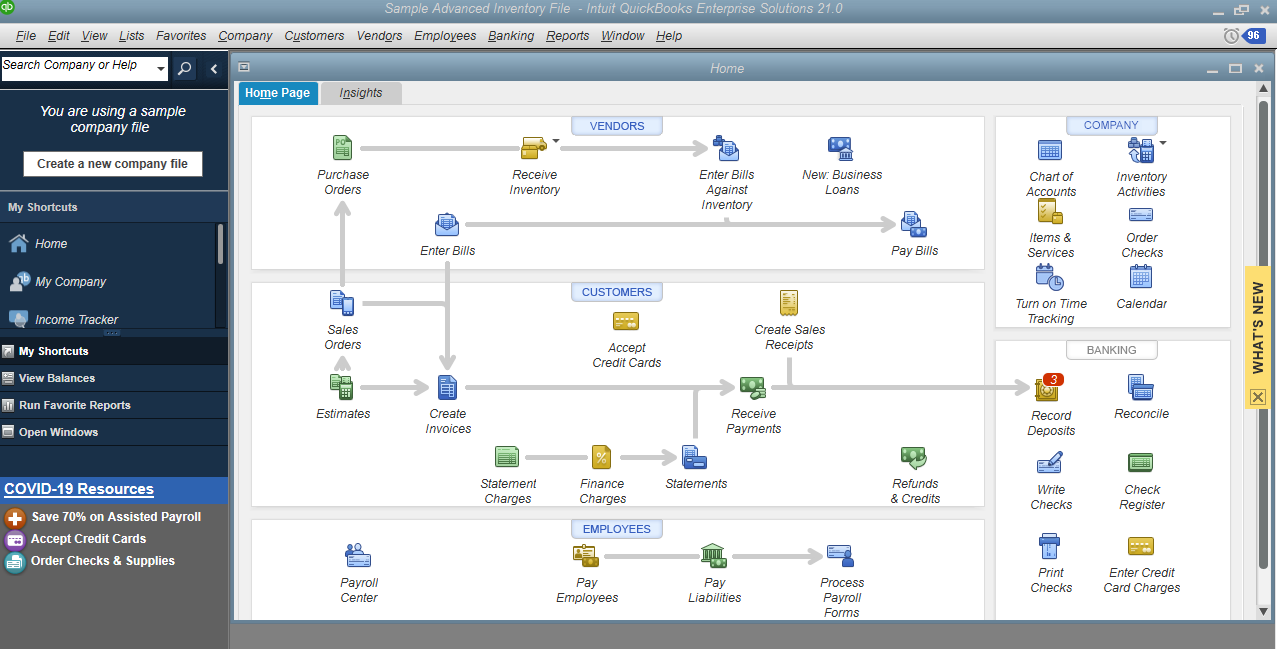

Otherwise, if the payment is simply deposited to the bank account as sales revenue, revenue will be recorded twice: once when the customer invoice is entered and again when the payment is recorded in the bank register. To avoid this common QuickBooks mistake, you must apply the payment against the invoice. Step 2: Record and apply the payment against an invoice Proper workflow follows three easy steps: When you receive the money for an invoice and record it in QuickBooks, the payment must be received and applied to the outstanding invoice, thus reducing the balance outstanding on the invoice then the payment needs to be deposited to the bank account. When you record an invoice, you’re also recording revenue. It’s easy to incorrectly record customer invoice payments as bank deposits rather than recording them as payments applied to outstanding invoices. Come tax time, overstated revenue causes your business to pay more in income tax. This mistake is terribly costly since you run the risk of overstating sales. It happens often, especially regarding small businesses that have recently switched over to QuickBooks. This is one of the most important QuickBooks mistakes to avoid. Avoid Mixing-Up Customer Invoice Payments with Bank Deposits

#Quickbooks accountants how to

Learn how to fix QuickBooks accounting mistakes and avoid terrible consequences. These common QuickBooks mistakes are easy to make, can derail your internal accounting, and cost your company money. It’s advantageous to learn the best ways to use QuickBooks so your accounting team avoids common mistakes.

0 kommentar(er)

0 kommentar(er)